Global Second-Largest Lithium Battery Recycling Company Plans IPO in Hong Kong!

On December 20, Guangdong Jinsheng New Energy Co., Ltd. (referred to as "Jinsheng New Energy") submitted its prospectus to the Hong Kong Stock Exchange, planning to IPO in Hong Kong. China International Capital Corporation (CICC) and CMB International are the joint sponsors.

Image: Jinsheng New Energy

According to the company's information, Jinsheng New Energy is a leading provider of comprehensive lithium battery recycling solutions in China. Its overall strength in lithium battery material regeneration and comprehensive utilization ranks among the top in the country. The company was selected as one of the "fifth batch of national specialized and innovative small giants." According to a Frost & Sullivan report, in 2023, the global sales volume of regenerated materials in the lithium battery recycling and regeneration solutions market reached approximately 1,169,700 tons. In terms of the 2023 regenerated material sales, the top five global lithium battery recycling and regeneration solution providers accounted for about 24.9%, with Jinsheng New Energy ranking second and holding a market share of approximately 5.0%.

The company's regeneration sector focuses on producing new material products such as battery-grade nickel sulfate, cobalt sulfate, lithium carbonate, ternary precursors, iron phosphate precursors, and lithium iron phosphate cathode materials. Its comprehensive utilization sector primarily involves the manufacturing of lithium battery products for diverse applications such as low-speed small power, industrial and commercial energy storage, outdoor power supplies, and solar streetlights. The company's recycling business covers mainstream battery systems, including ternary lithium batteries and lithium iron phosphate batteries, with products widely used in downstream applications such as electric vehicles, energy storage systems, and consumer electronics. Both the company and its wholly-owned subsidiary, "Jiangxi Ruida New Energy Technology Co., Ltd.," are listed on the Ministry of Industry and Information Technology's dual whitelist for battery recycling and secondary utilization.

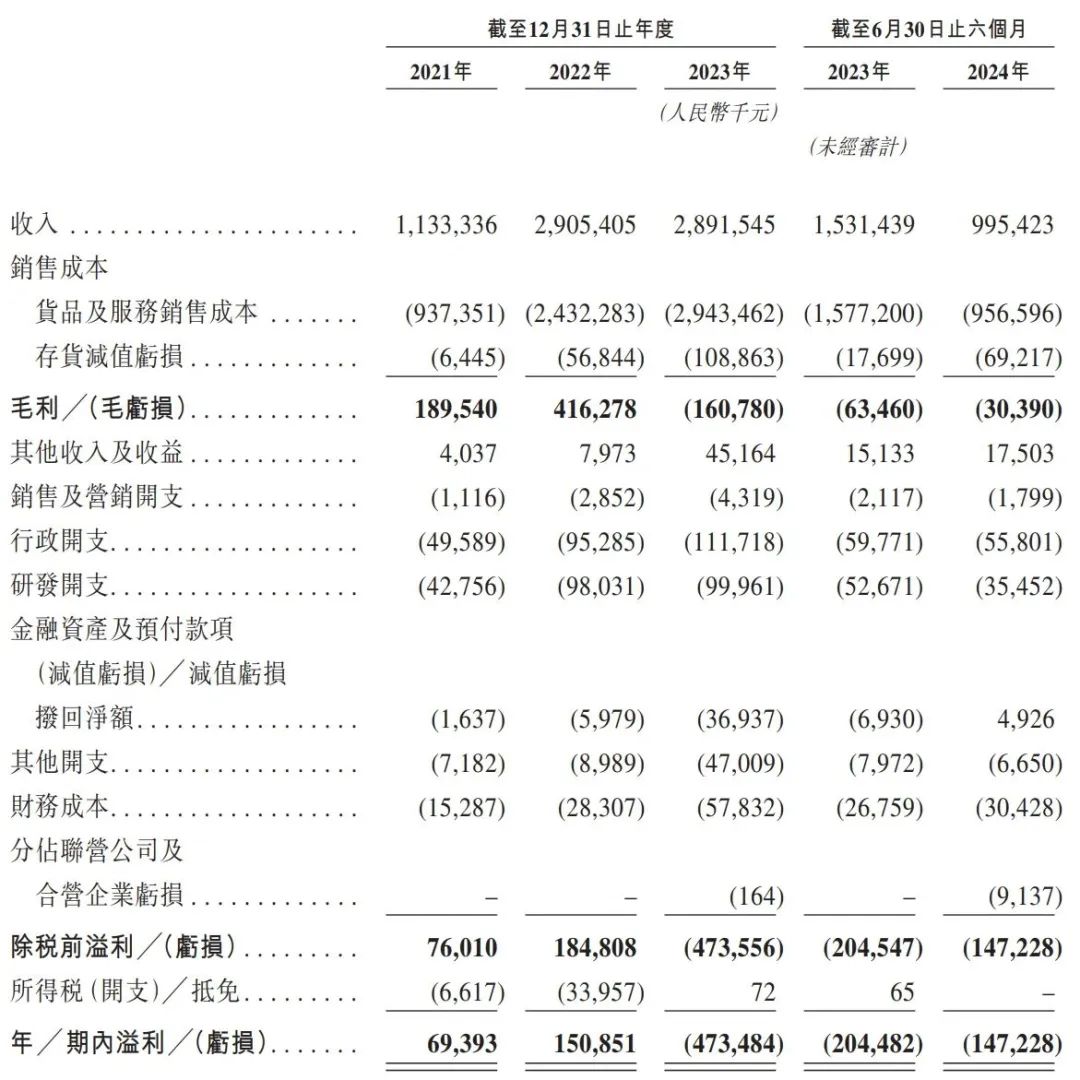

According to the prospectus, Jinsheng New Energy's revenues for 2021, 2022, and 2023 were 1.133 billion yuan, 2.905 billion yuan, and 2.892 billion yuan, respectively. Its gross profit was 190 million yuan, 416 million yuan, and -161 million yuan, respectively.

In terms of ownership structure, the Li brothers—Li Sen, Li Xin, Li Yao, Li Yan, and Li Wang—control a total of 55.05% of the voting rights, either directly or indirectly, making them the actual controllers of Jinsheng New Energy. Additionally, the employee shareholding platform Zhaoqing Shengda holds 5.45%, and several well-known investment institutions and enterprises, such as Guangzhou Yingtao, Changsheng Investment, China Electric Power, and Fosun International, also hold varying percentages of shares.

Jinsheng New Energy has completed five rounds of financing, gaining recognition from major financial institutions and industry players, including CICC, China Chengtong, Fosun Ruijing, GAC, Shaanxi Automobile, Bosch, and others. It was also included in the 2024 Hurun Global Unicorn list.

In November 2023, Jinsheng New Energy signed a "dual-container dual-commitment" agreement with the Zhaoqing Gaoyao District Administrative Service Center, directly committing to the implementation of a waste lithium battery resource recycling and reutilization project. The total investment for the project is 1.19 billion yuan, and once completed, it is expected to achieve an annual output value of 1.5 billion yuan.

Source: Jinsheng New Energy, Battery Network, etc.